Prologue

Current intellectual discourse in Indian context is to reclaim its deserved place at world economic stage, something akin to glory days from before year 1700 when it contributed 30% of world GDP, at least proportional to its human share of the world.

It’s good to acknowledge the context of that world where almost entire humanity did manual farming, technology had yet to be a thing, size of an economy primarily depended on the nation’s population and India has the most arable land on the planet.

India’s share of global GDP fell below 2% in 1900 due to not only internal reasons (invasion, colonisation, socialism) but, also because other nation states rapidly adopted industrialization to boost their productivity and broke out of malthusian trap.

Let’s dive into contemporary India with a major caveat that estimated +80% of India’s labor force works in informal sector and contributes +50% of the GDP - leading to majority of datasets collection via sampling / surveys instead of full calculation and is internationally graded C / A-E for its quality.

Even discounting for biases of north atlantic rating organizations, having seen government personnel at work - most people will concur with the quality assessment.

Analysis

In 2024, India contributes 8% to world GDP with 18% of world population.

So Economy of India is at least 2.25x off its expected place in an average world and should be able to aim for with a really strong effort over the coming years.

But, to break out of the Middle income trap and become a developed & wealthy nation generally requires foundational reforms, political willpower & social awakening.

Key Indicators

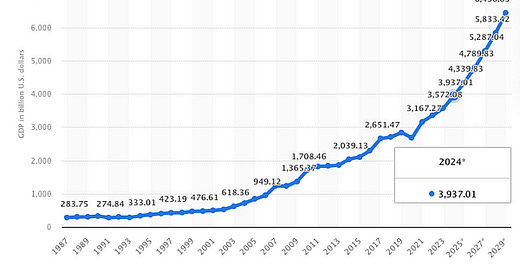

India has grown to become 5th largest economy with $3.9T GDP, trending towards 3rd position with fastest growth rate of 7% among the major economies.

India has foreign reserves of $630B, one of the highest in world.

India has been able to get hold of runaway double digit inflation and able to hold RBI mandate at 4% with ±2% margin, albeit still on the higher end.

A sobering point to note is that despite the total economy size at 5th position in the world, India remains an extremely poor country due to the sheer size of its 1.44B population puts its GDP / capita around $2,500 placing it at 148th out of 189 nations.

Key topline metrics things seem to be trending right, but devil is always in the details.

GDP = C + G + I + NX

Indian economy components that contribute to GDP have essentially been 60% Private Consumption, 10% Government Expenditure & 30% Investments.

→ C = Consumption (Private final consumption expenditure)

60% contribution to GDP is from Private consumption. This is atypically high at this stage of economic development among eventual success stories of past century via export led growth. For comparison, China is at 37% and has never been this high.

This itself is a factor but actual point worth noticing is who is doing the consumption?

A good model for segmentation is: India 1 2 3 initially framed by Kishore Biyani.

India 1: Consuming class, ~100M people, Income > $10K

India 2: Serving class , ~300M people, Income = $3-5K

India 3: Struggling class , ~1000M people, Income < $1K

This essentially means the biggest component of India’s GDP essentially comes from < 10% of population which has any capacity of value-added consumption that can trickle down rest of the economy.

Overall India spends 75% on groceries and only 25% for discretionary spending.

And it doesn’t look like beyond top 10% of population, things are growing fast enough to move people across the segments at a rapid pace and actually trending opposite.

→ G = Government (Government final consumption expenditure)

10% contribution to GDP is from Government expenditure which seems to be trending in line with typical spending at this economic stage, including peer nations.

Other than needed operating needs of gov (wages, pensions etc), 2 points stand out:

Social Welfare spending of all sorts have totalled in range of 8-13% of GDP including Guaranteed employment and Direct benefits transfer (Cash or Kind) to approximately 800M people or 60% of population.

As expected - these programs are quite popular among recipients, but creating a circular blocker for growth - where neither people are forced to skill up to become productive nor urbanising fast which can create economic flywheel.

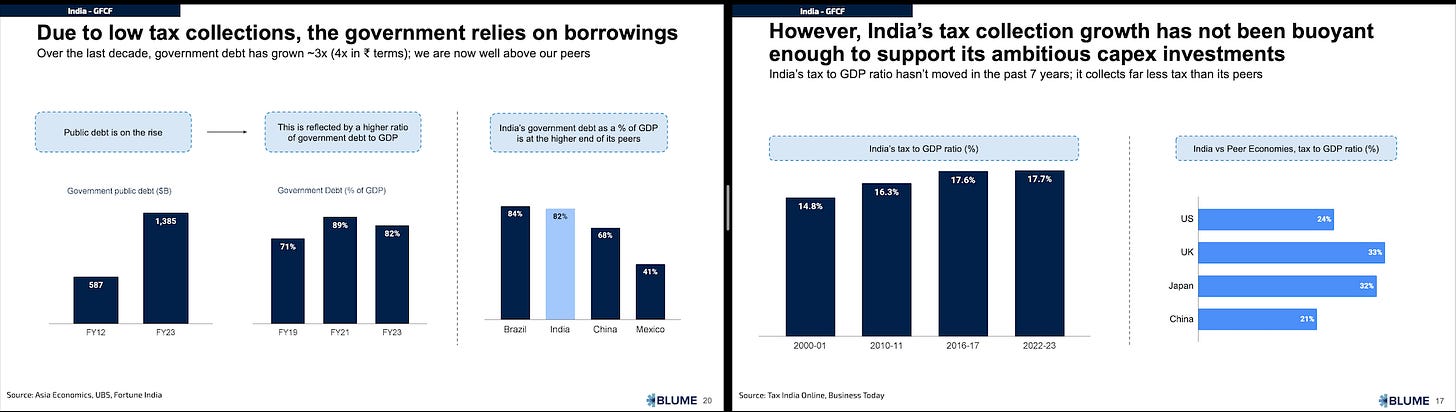

A freebie quagmire where social welfare for all is an enshrined ideal, while most countries have ramped up the safety net efforts only around $10,000 per capita.Debt to GDP ratio of India stands at 83%, which is >2x the recommendation for countries in this economic stage and is causing government to spend 20% of its annual budget on just servicing interest instead of putting it to productive use.

Seems tricky to funnel growth with high debt levels ahead, while inability to increase direct tax base (1.5% taxpayer population) as well as increase tax to GDP ratio beyond 17% comparable to peers.

→ I = Investment (Gross fixed capital formation)

30% contribution to GDP is from Gross fixed capital formation. Building public physical infrastructure (highways, ports, airports etc) has been a key government initiative in recent years. This rightly gets a ton of attention for right reasons

India hasn’t broke out of high 20s, whereas China has been consistently in mid 40s.

Key reason being GFCF primarily driven by government due to low tax collections, large welfare commitments and absence of private sector at scale due to lack of credit.

Foreign Direct Investment also peaked in 2008 at 3.6% of GDP and has since trended down to 1.5%, which is much lower than what China averaged consistently above 4%.

Incidentally, FDI has been superceded by remittances as the primary source of foreign money transfers into the economy at 3.5% of GDP and trending upwards as well.

→ NX = Net Exports (Exports - Imports)

India has consistently been a net importer, which generally adds up to -5% of GDP - this is specially worrying given all the economic success stories in post-war environment have been export led on the back of globalization.

India heavily indexes on low domestic value add items and this ratio is decreasing as share of GDP over time. Overall DVA ratio is low for Agriculture, Manufacturing sectors with an exception being Services sector that has high value added activities.

Sectors of Economy

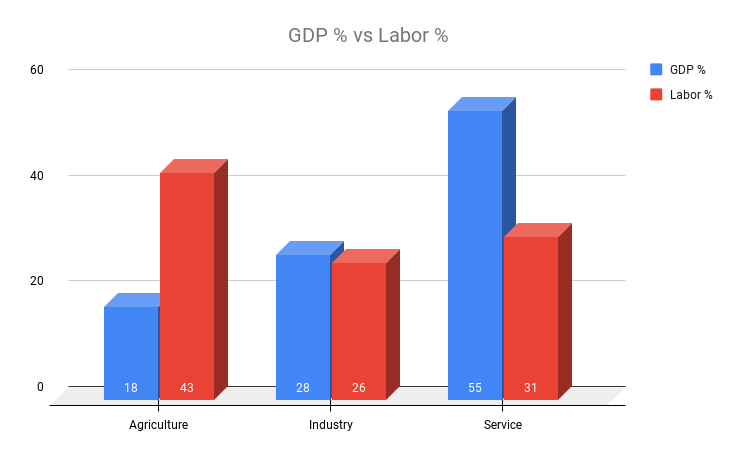

A way to visualize an Economy is to employment & GDP distribution across sectors.

Classic economic development path for most countries has followed transition through sectors: Agriculture → Manufacturing → Service. Let’s see each sector.

Agriculture

43% of total workers in Agriculture sector contribute 18% to the GDP. India has become food secure by being leader in major crops production in the world.

On input side, India has oversupply of labor for myriad of structural reasons.

On output side, India is a nation with most arable land, but it’s yield is typically estimated 30-50% lower than the state of art in the world.

For comparison, US with 2nd largest farmland produces less output value in same proportion, but with 100x less labor (200M vs 2M), so gross value added per worker is 50x higher ($100K vs $2K) than of an Indian farmer. Also total factor productivity growth remains low at 2%, whereas China has sustained 6% growth despite having similar small landholding farmers (Indian farms average 1 hectare).

Despite recent efforts to bring fundamentally needed reforms to the sector that can boost productivity and transformation of labor allocation at scale, it has failed.Manufacturing

26% of total workers in Industrial sector contribute 28% to the GDP.

India has made effort to boost manufacturing in India that can provide productive employment at scale to growing labor force. Sector’s value add has been increasing consistently, but it’s GDP share has trended down to 13%.

India has a narrow window of opportunity in post-COVID world to ride the China + 1 wave. But, internal problems (unemployability, regulatory burdens, lack of private credit, globally competitive quality) seem like blockers to capture it.

Despite major initiatives to boost the sector, instead of much needed labor intensive industries, capital intensive are the ones getting attracted to incentives.Service

31% of total workers in Service sector contribute to 55% to the GDP, which has been a key growth contributor over past decades with the highest value add contribution at 50% of the GDP.

Professional services (IT, BPO etc) add up to half of this golden story and formal employment consistently and will remain so ahead but it’s employment capacity may have peaked already with the boom of AI and viability of industry’s transition from backoffice work to customer facing global products remain to be seen.

Retail (In hospitality or ecommerce supply chain) seems like another prime area.

Other relevant indicators

Few more relevant indicators that matter in regular life connected to macroeconomy:

Currency

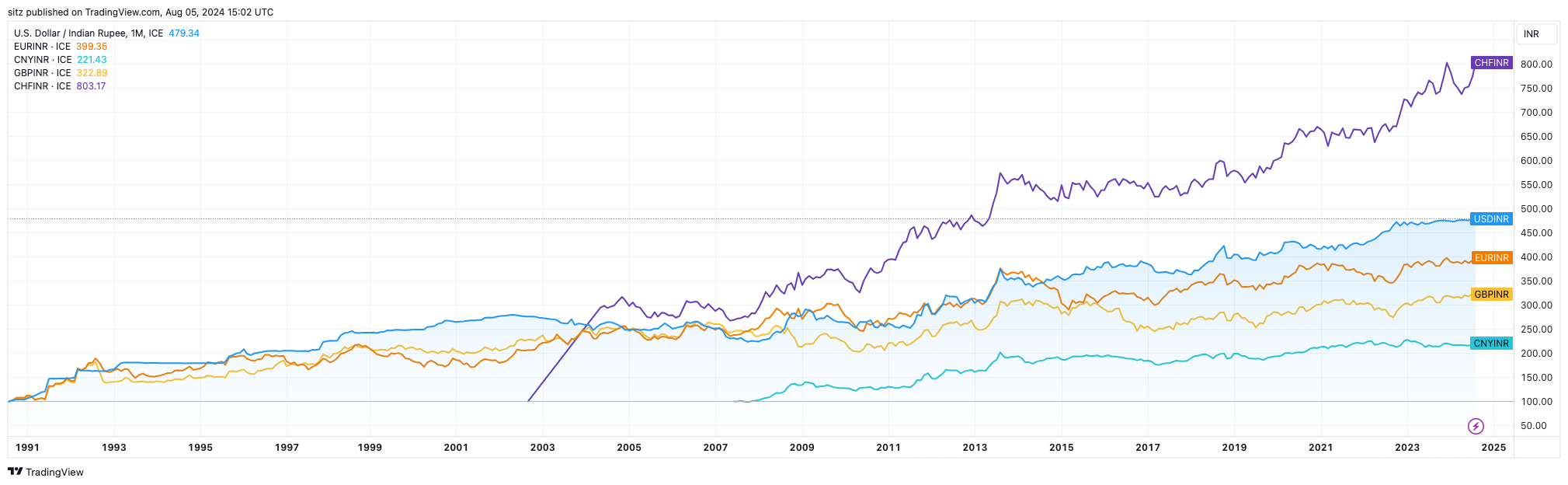

Global forex markets are great indicators for relative strength of respective economies and INR has been a consistently depreciating tender against all the major currencies.

Over time, this makes importing anything to the country expensive (an issue being a net importer), increases the debt burden (India spends 20% of entire budget with debt of 80% of the GDP), creates affordability problem for global travel / education etc.

Income & Wealth

Indian economy kept everyone equally poor till 1991 and since liberalization has still enabled ~10% of the population to prosper. Both wealth and income distribution display skewed power curve behavior. Inequality itself is not a problem if every segment is growing well, but that is not the case.

When a monthly wage of INR 25,000 or $300 makes one part of top 10% earning class - a vast set of the bottom 90% of population lives very close to poverty - 80% supported by government welfare of sorts, is a dire situation.

Demographics & Employment

India boasts of having a demographic dividend for the coming decades in terms of its sheer size that automatically makes it next economic miracle. But, that’s not an automatic right and has be earned by creating right conditions for its populace.

Despite the quantity, quality of the the population remains low - creating a weird combination of shortage of talent along with persistent high unemployment, especially in younger segment and always had low female labor participation.

On looking at key metrics - India has made amazing progress on essentials of life, but has yet to get mission mode on things that make population productive at scale like formal education and health / hunger for optimal mental and physical development.

Only 25% of the jobs in organized sector has been a failure to get people productive in stable environment. Only 2% of the the population can be employed in public sector and given the terrible entry level private jobs - people would rather take a handout.

Hence the reason any level of government jobs are extremely popular for job seekers.

Eg. In 2024, 1.3M candidates appeared in UPSC exams for 1000 vacancies, a 100x ratio remains quite common for all levels of public sector openings as well.

Epilogue

Recently, I witnessed 2 extreme contrast regions of the planet with 100x gap in wealth as well as the topic de jour regarding vision for the next decade that is overwhelming:

San Francisco, USA — AGI will be here and a world of abundance awaits with no need for jobs and a universal basic income establishment.

Bihar, India — We should be able to get a starter daily wage labor job for everyone so maybe one doesn’t need to migrate 1000 kms away from family for a basic existence.

But, even if one doesn’t believe the hype of AGI, the clock is ticking for India and it has ±30 years on the clock to get rich or be doomed forever to stay a poor country.

Once the median age of a country crosses over 45 years, economic growth rate starts to decline and India is projected to cross that mark around the year 2055.

So, Can India get rich before it starts to get old?

A point worth noting is that in the post-war world, no successful economic stories have been full democracies and have been able to get past tyranny of the majority.

The underlying fundamental issues require strong political will to reform the institutions and people involved and break out of the middle income trap, but those continue to not happen for a reason.

Quoting Ruchir Sharma, India’s political DNA is fundamentally socialist and statist, and that this basic outlook defines the worldview of all the leading parties.

A good rule of thumb for India has been it grows at World +3% growth rate.

India consistently disappoints the optimists and the pessimists.