Background

In 2019, I bought an apartment in Amsterdam, became a first-time homeowner in the Netherlands, and learned how home accounts for the largest transaction size and the asset to hold a majority of net worth for most people through the buying process.

Over the past 5 years, It served well as a home, unintended office through covid and afterward, and a central city location as a city experiences hub. But, the constraints of this cute little space, upcoming rental price caps, and the process of moving my base city location made owning it sub-optimal going forward; hence I decided to sell it.

Sale Timeline

Nov 15: Hire a real estate agent / makelaar (KRK)

Nov 21: Deep cleaning

Nov 23: Staging and Styling (Kalter & Kalter)

Nov 24: Photography

Nov 24: Measurements

Nov 24: Create and sign power of attorney with notary (Brummelhuis)

Nov 29: Listing live on online market (funda.nl)

Nov 30 - Feb 19: Buyer viewings (move.nl)

Feb 19: Bidding deadline

Mar 02: Sign purchase deed with notary (NVA Notaris)

Apr 14: Move personal household items (Student Verhuis Service)

Apr 15: Sign transfer deed with notary; Financial settlement

Home Transaction Learnings

1. Financial Analysis

WOZ value is the baseline assessment for properties in official intent in Netherlands and they track well with actual market prices adjusted for demand/supply pressures.

Using a simple linear model estimate of WOZ value for the next year of purchase, I had estimated it to reach €337K. I bought it for €325K. In actuality, it reached €329K.

To set the 2024 sale price, I triangulated using the WOZ value projection, market survey report from Walter Living, and transaction trends estimation from Funda.

For November 2023, all of them pointed around €395K ± €20K as the potential price range. I agreed to set the sale price at that midpoint. It eventually sold for €396K.

Profitable?

Overall 4.5 years of apartment ownership netted me a gain of €71K (€396K - €325K).

Unlike 2% transaction tax on the purchase, there isn’t a government tax on the sale of property and unlike many countries, Netherlands doesn’t tax capital gains either.

But fees for RE agent, notary, stylist, etc still ended eating up ±2% of the total payout.

Ex-post, although the transaction decision was net positive, I overbought and undersold to ideal price points to hit my ex-ante expectation of 10% annual returns from owning the property in Amsterdam. It was cut down by half to ~5% in reality.

2. Choose the real estate agent wisely

I didn’t use a RE agent during purchase as didn’t seem worth it, but the perceived complexity of the sales process, it seemed like an expert might yield better results.

I set up orientation meetings with the 5 most active agencies in my zip code to get their expert take on market, price, and other strategic details to run the sales process.

Eventually, I picked the lady with the most proactive attitude and a 1.25% fee quote.

In hindsight, that decision would cause me a ton of headaches as has happened with using an intermediary expert/consultant in the Netherlands every single time for me.

Interactions with her were pleasant, she took care of compiling details, ran the coordination process among relevant parties, and viewing appointments to prospects.

But, she was out of depth on strategy or didn’t act proactively which ended up causing:

› massive delay in completing the transaction (5 months vs expected 2 months)

› unable to build momentum (go live at the right time, go low to go high on price)

› generating only 2 offers despite dozens of viewings and lots of listing traffic

› lowballed on the sale price (crossing the minimum acceptable threshold by sole bid)

› billed a bunch of unexpected costs to handle new situations due to reactivity

I was going to be away from the city during the process and had to finish the process by hitting the April deadline. So, despite the subpar approach becoming clear mid-way, firing her and restarting seemed more tricky, and had to adjust, unfortunately.

Lessons for next time?

› Vet thoroughly and check the agent’s direct sale references, not their agency, as they would be solely responsible for completing the actual transaction process.

› Make sure to plan out the complete strategy by digging on my own instead of delegating fully as the process still ended up forcing me to research for judgment.

› Ensure performance-based payoff on the delta above the purchase price to create full alignment. Keeping the agent’s fee based on total cost takes away the value of incremental price gain for the owner given that’d only amount to a fraction for agent.

3. Timing of the sale

As usual with any dealmaking, having time on your side is always leverage. Because I had time-boxed the process to be finished before April ‘24, I was stuck with the initial process and couldn’t reset mid-way unfortunately despite noticing sub-optimality.

This listing went online in November and within a week it was clear that no one looks for houses around the extended holiday season between Nov - Jan and would have been better served in going offline and coming back on the market in spring again.

Combining that with hindsight in price evolution of the apartment over last year, including the anecdotal sale price of neighbor’s home in spring, ±10% was left on table.

4. Reliable ground presence

I had plans to be away from the city during the process, had put a power of attorney, and required services with remote availability for any unresolved queries.

This was a major mistake and caused immense hassle, expenses, and wastage.

Arranging any physical service remotely is just trouble - cleaning, repairs, movers, etc.

Most often people will turn up unreliable (last minute cancel, reschedule, no show), price gouging (unexpected billing in the absence of supervision), or take advantage (student movers failed to deliver, tried to scam with made-up overnight fees as side hustle scam and eventually resulted in trashing items worth 100s of €) if given chance.

Just be present to do it yourself or assign a reliable person to oversee the entire thing.

Home Ownership Learnings

1. Expenses

Being a homeowner comes in the form of a series of direct debits popping up in your bank account. It’s important to amortize all those costs to understand the full picture.

Let’s look at the breakdown of regular costs associated with living in an owned house.

Overall, it seems like a baseline annual expense of owning a house in Amsterdam and using it as primary residence turns out to be ±5% of the property value, varying by the number of people living and other lifestyle choices associated with it of course.

Additionally, given interest payments on Mortgages are tax deductible in the Netherlands, that’d take another percent off that cost by netting it out.

Eg. My annuity mortgage had an annual payable of €14K, including €6K interests.

› Rent vs Buy?

In the above scenario, annual net expenses are squared up with property value gains, and owning the property makes living there essentially free. Buying to live is a no-brainer, but obviously may vary by different city, interest rate, and other choices.

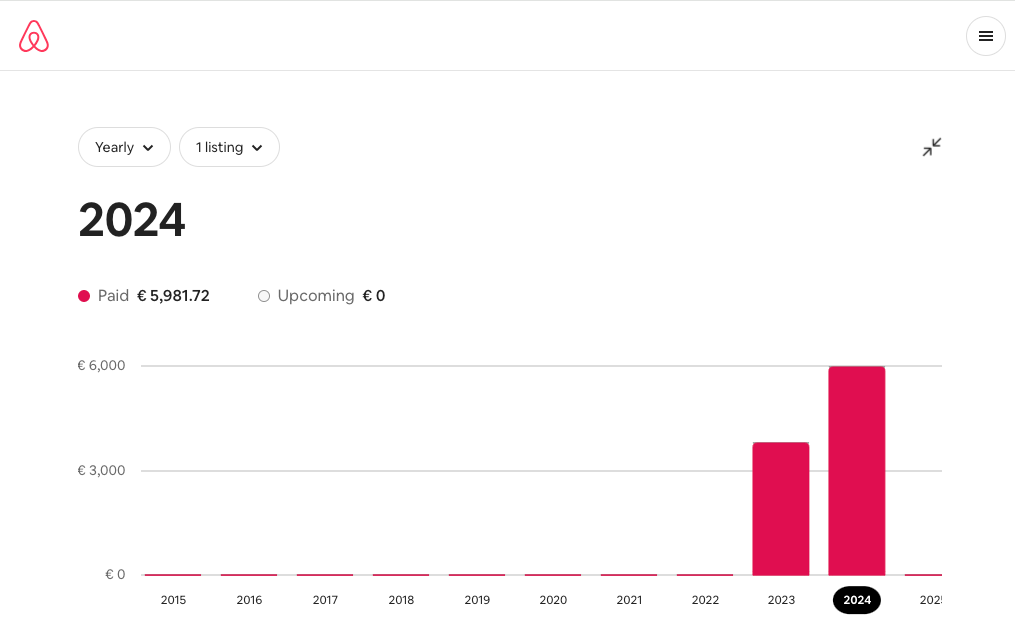

› Home income?

Given Amsterdam is a major hub for travel in Europe, a home can be a bonus income generator for owners while away from the city, and monthly yield from short-term rentals in the city can be ±2% of the property value quite conveniently.

Unfortunately, Dutch regulations limit this category use to 30d/year, but still a pretty good option to more than cover holiday expenses by using it as a home swap.

2. Vet Home Owners Association (VVE)

Each homeowner has to be part of VVE in the Netherlands by law, so it’s important to check the overall condition and its member’s standings in it to avoid trouble. It always feels like a hassle dealing with VVE until it’s too late and emergency costs a ton to fix.

Ours was a small VVE of 5 members in this old building from 1856, which already needed tons of work to maintain (repair, painting, insurance, etc costs are high).

In addition, the ground floor was rented commercially to a restaurant - which had equal member contribution but with 1000x higher footfall and potential wear & tear.

Each year, that ground-level owner will find a major issue, and dump it on VVE by finding the quirks in partition bylaws. On attempting to discuss, that owner will just try to threaten to go to court and potentially put the VVE to pay for the legal fees as well. No one wants to deal with another hassle and all 4 residential owners would end up sharing the burden by paying for those out-of-pocket expenses as well.

Lesson for next time?

›Thoroughly comb through VVE docs to see structures under common ownership.

› Do not mix residential and commercial ownerships.

› Ensure fairness of VVE contributions.

3. Maintain neighbors

In major cities, as it’s extremely uncommon to even know your neighbors anymore - being a homeowner makes the realization of having good neighbors essential. It takes effort, but try to do regular drinks/dinners/housewarming/parties to build an immediate social network - it creates a feeling of belonging in the home building.

In addition to that, immediate neighbors are always the first set of people who can help each other out in emergencies - fire, theft, lost key, or something weirder.

Overall, owning a house does feel pretty nice, is a savvy choice from a financial perspective, and creates a healthy relationship with the city where we make our base.

If you can see beyond the next 2 years on your horizon, just buy a home vs renting one. I am keen to find out the next city as the base location and own a home there.